On 26 July, 2022, the International Monetary Fund (IMF) ‘issued a warning’ to sovereign-states adopting Bitcoin and other crypto-currencies as legal tender; as was recently the case in El Salvador.

The article, published on the IMF blog, is littered with inaccuracies and misunderstandings. This is unfortunately still common, where comprehension of the fundamentals of Bitcoin is difficult for most people to grasp.

We will go through the key points of the article to both provide clarity and refutation. We have referenced points verbatim and, in some instances, we have lumped them together when they form part of the same argument;

“it [Bitcoin] is an opportunity to transact anonymously”

“Without robust anti-money laundering and combating the financing of terrorism measures, cryptoassets can be used to launder ill-gotten money, fund terrorism, and evade taxes.”

Bitcoin was never intended to be an anonymous payment system. Others digital coins, such as Monero and Zcash, were created to fill that void. All bitcoin transactions are recorded on the blockchain, where wallet addresses are pesudonenymous but not completely private. Purchasing bitcoins requires one to open an account with an exchange and with the exception of only one or two (localbitcoins and hodlhodl) you have to go through KYC and AML protocols.

Even if you purchase bitcoins through a private exchange there is still a digital trace as you would have used your credit card, PayPal or SWIFT system linked to your personal bank account.

To date the most efficient means to “launder ill-gotten money, fund terrorism, and evade taxes” is cash, issued by central banks.

“Cryptoassets are unlikely to catch on in countries with stable inflation and exchange rates, and credible institutions. Households and businesses would have very little incentive to price or save in a parallel cryptoasset such as Bitcoin, even if it were given legal tender or currency status. Their value is just too volatile and unrelated to the real economy.”

Let’s presume that the article is referring to the key members of the IMF when asserting ‘countries with stable inflation and exchange rates, and credible institutions’.

The IMF does not operate like the UN General Assembly where it’s one vote per member. Voting power of the IMF is dependent on the amount of donations each sovereign state avoids. Essentially voting rights are both. The controlling sovereign state members of the IMF by voting power are the USA, Japan, Germany, France, UK, Italy, Canada, China and Russia.

Though membership of the IMF is 190 countries, decisions affecting all of them are made by these nine states.

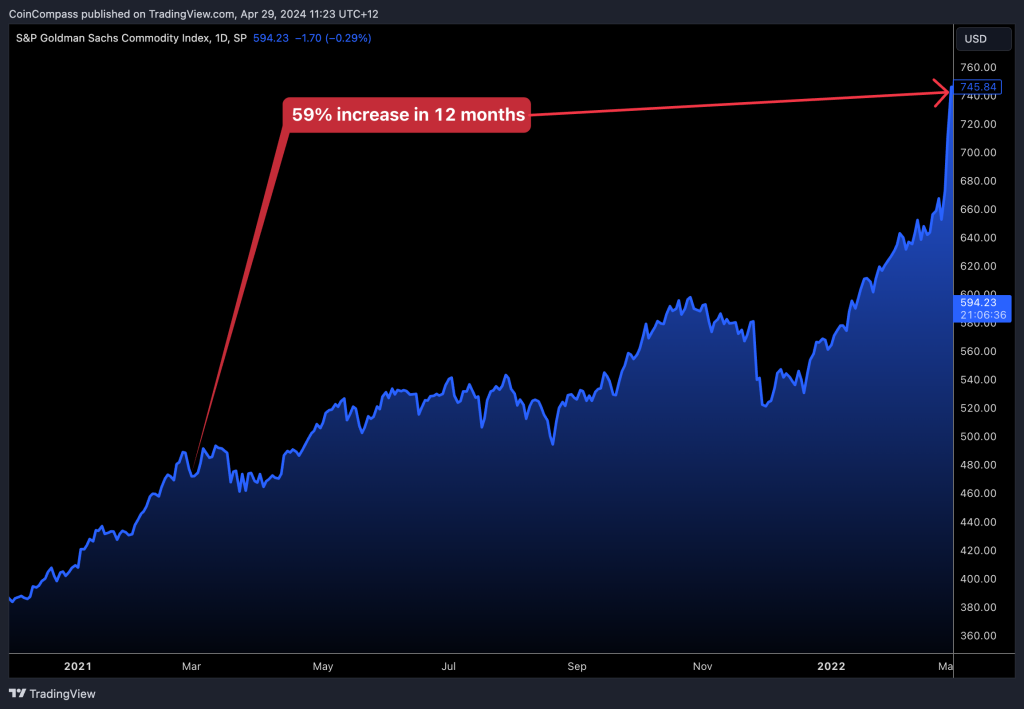

When referring to ‘stable inflation’ what is the barometer? If one looks at the S&P GSCI that tracks 24 commodities from all sectors, it has appreciated over 59% in the past 12 months.

Wage inflation in the US has increased 10%, yet considering that commodities (energy, metals, grains…) are the basis for our global consumer based economy, I would not label a 59% increase in the price of the underlying assets as ‘stable’.

A stable currency is measured not only by purchasing power but in comparison to other currencies.

Stable exchange rates is relative as one would need to compare them to a common denominator. If we used gold as said denominator then the USD, EUR, GBP and RNM have all depreciated by 30% compared to gold in the last decade.

So one begs the question, what is a stable currency? It doesn’t appear that there are any in the IMF.

Credible institutions is a somewhat laughable premise as the largest and most ‘credible’ banks are continuously fined record amounts for corruption and money laundering.

The greed and corruption by these institutions not only led to the 2008 Global Financial Crisis (and in causing the crash their bonuses for doing so were paid for by the American tax-payer), but since 2008 banks around the world have paid US$321 billion in fines for malfeasance. This is included the 1MDB scandal where the Malaysian sovereign wealth fund, with the assistance of US bank Goldman Sachs, was siphoned by more than US$4 billion. These funds, the property of the Malaysian tax payer, were stolen by high-ranking government officials to purchase luxury goods for themselves, including a $250million yacht.

“A cryptoasset might catch on as a vehicle for unbanked people to make payments, but not to store value. It would be immediately exchanged into real currency upon receipt.”

This has historically been disproven by Gresham’s Law. If a currency is expected to increase in value it will be saved while the weaker currency (the one most likely to lose value) will be spent. This was the case with the Denari after the Peloppenisian war and in countries today facing hyper-inflation such as Venezuela.

“Finally, mined cryptoassets such as Bitcoin require an enormous amount of electricity to power the computer networks that verify transactions. The ecological implications of adopting these cryptoassets as a national currency could be dire.”

Of all the arguments against Bitcoin, this is perhaps the weakest. Bitcoin is providing a store of value and a currency to the more than two billion unbanked adults in the world. So when arguing that it is using an enormous amount of electricity it needs to compared to a similar service. The SWIFT banking system uses twice the amount of energy as bitcoin, as does the gold industry.

Bitcoin is both a currency and store of value that therefore use one-fifth the electric of both gold and cash.

References

Cryptoassets as National Currency? A Step Too Far. By Tobias Adrian and Rhoda Weeks-Brown, 26/07/2021

https://blogs.imf.org/2021/07/26/cryptoassets-as-national-currency-a-step-too-far/

Banks paid $321 billion in fines since financial crisis: BCG Reuters, 3 March 2021. https://www.reuters.com/article/us-banks-fines-idUSKBN1692Y2

Timeline: How Malaysia’s 1MDB financial scandal unfolded. 28 July 2020 https://www.aljazeera.com/news/2020/7/28/timeline-how-malaysias-1mdb-financial-scandal-unfolded

Here’s the staggering amount banks have been fined since the financial crisis. Steve Goldstein,. 24 Feb 2018.

https://www.marketwatch.com/story/banks-have-been-fined-a-staggering-243-billion-since-the-financial-crisis-2018-02-20

On Bitcoin’s Energy Consumption: A Quantitative Approach to a Subjective Question. Rybarczyk, R. Armstrong D. & Fabiano Amanda. Galaxy Digital. https://docsend.com/view/adwmdeeyfvqwecj2

Charts by Tradingview.com

Article originally written on 3 August 2021, chart was updated on 5 March 2022.